In this consultation paper on algo trading published yesterday, SEBI sought views from intermediaries and all stakeholders about the discussion points highlighted by them. The working group at SEBI has proposed the following framework for retail algo trading:

- All algos need to be approved by the exchange and identified by unique Algo IDs.

- Each algo should be certified by a CISA/DISA auditor.

- All algos should run on the brokers' servers.

- API level RMS checks to be ensured by brokers to prevent misfiring trades.

- A broker can offer in-house strategies or will have to enter into agreements with third parties.

- Stockbrokers must assess the suitability for investors before offering algo facilities.

- 2FA should be built into the system.

- Software used to create algo strategies should be approved by the exchange.

- Brokers should submit details of checks & balances for algos during annual system audit reports as per the format provided by the exchanges

- More clarity is required on the nature of services rendered by third party algo service providers. Currently, there is a very limited understanding about whether they are research analysts offering strategies or creating strategies based on traders' requirements etc.

My thoughts:

- SEBI's concerns are very legitimate because, in the history of capital markets, unqualified persons rendering advice have led to a lot of avoidable losses for retail investors. To streamline the advisory business and to prevent irresponsible advisory practices, they introduced the Registered Investment Advisors (RIA) concept to make sure only certified persons/entities can advise their clients. However, due to the stringent compliance requirements, many have chosen to remain unregistered and operate outside the regulatory framework. It would be great if the compliance & other requirements are eased a bit to encourage people to take this path.

- Traditional tipsters who used to give buy/sell calls offline are now masquerading as algo experts. Overfitted & skewed backtested results lure retail investors to believe that it will happen in reality (It might happen for a while but then it's not as easy as it is made to seem). As a matter of fact, these back-tested results are not audited, certified and thus, is an area of concern. In the past, tipsters from Indore and other places were notorious in promising unbeatable returns and obviously under-delivering. The regulator wants to be sure that this ecosystem develops in the right manner.

- Algo trading is the natural evolution of trading manually. Retail traders do not trade full-time because they work at jobs/businesses and participate in the markets to earn additional income or to grow their capital. For many, tracking the markets manually and waiting for prices to arrive before they can trade can use up a lot of their valuable time & energy which they much rather devote to their jobs which requires their presence of mind. Hindering traders' ability to participate objectively can be a regressive move.

- Algo trading helps retail traders approach the markets objectively as it eliminates emotions from the decision-making process. The benefits of this approach are multi-fold. The vast majority of the losses incurred by retail traders are because of emotional impulses. Access to algo trading helps avoid blunderous trading mistakes. The results of their trading strategy can be analyzed and optimized. The capital deployment is well thought out as compared to discretionary trading. Traders will last longer in the markets to learn, deploy new strategies, and evolve with the marketplace. Although it is debatable, it can increase the odds of long-term survival. All this is positive for the capital markets. Over-regulation can kill this vibrant space in its infancy. I'm sure SEBI is concerned about the effects that tipsters will have and the too-good-to-be-true pseudo-fund managers.

- In general, algo traders are suspicious of getting their strategies tested & approved by the exchanges because they believe their strategies will get exposed and will be ultimately used by some secretive HFT/murky operators. It is natural to feel this way but the exchange essentially looks at the risk management elements of the trading strategy. They're not concerned about the potential profitability of your trading strategy. You'll have to be less worried about the exchange and in this case, be more worried about the broker! Why? The answer is simple - Proprietary trading. As I have said before, brokers' prop desks can be notorious, and are constantly looking for new trading ideas from wherever they can find them. What better than a profitable algo trading client who has to expose the blueprint to his success because of regulations? One way you can avoid this conflict of interest is by choosing a broker that doesn't do any prop trading. FYERS is among the only few brokerages that don't have a prop desk so there's no risk of your strategy being misused.

Apart from that, it's impractical to get all strategies approved at a client level, and here's why:

- Exchange test environment (mock sessions) happens once a month only.

- At times, testing may require more than is available during mock sessions.

- Trading strategies change all the time. Getting every change approved is a nightmare scenario.

- It is burdensome for the exchange/s & brokerages to deal with the growing number of approval requests for any changes made to the trading strategies.

- It'll increase the costs for retail traders due to services rendered by brokers & CISA/DISA auditors.

- If the broker's systems go down, there will be no way that the retail clients can manage their risks. Currently, they can switch off their strategy if there is any problem with the broker's API because it is hosted by the clients or some third-party platform.

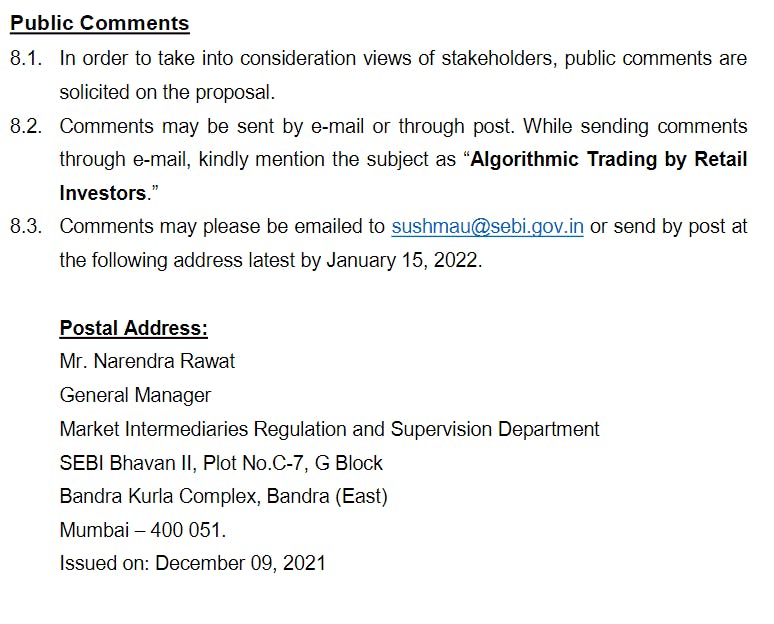

We hope the regulator takes a constructive stance w.r.t retail algo trading and sees the long-term benefits of systematic trading. It can create a level playing field for retail investors as compared to prop desks, deepen our financial markets, promote rational risk-taking among all participants, potentially increase the survival rate of traders, and overall increase the market participation nobody has the time to track markets all day; it would reduce their productivity at their workplace. Let's see what happens next. This is all we know for now. We encourage you to write your comments & send your constructive feedback to the following address:

P.S - We understand that many retail traders are vocal critics of SEBI for the peak margin implementation and other recent regulations but please understand that they're doing all this to safeguard your interests. The intent cannot be overlooked. If you wish to send your feedback, kindly write your points objectively and request them to look at it from your point of view. No point in being rude or aggressive! 10 years later when we look back, I'm sure we'll feel lucky to have had a vigilant regular like SEBI.