MCX is all set to add a third commodity sectoral index to its basket of index futures, after having introduced the iCOMDEX Bullion and the iCOMDEX Base Metals index last year. This time, the exchange would be introducing the iCOMDEX Energy index, which would be available for trading from 7th October 2021.

About the index and its composition:

The iCOMDEX Energy index is an excess return index (price return + rollover yield return) that is derived from the price of two individual energy commodities traded on the MCX – Crude Oil and Natural Gas near-month futures contracts. The current weights of individual constituents in the index are as follows:

Crude oil: 75%

Natural Gas: 25%

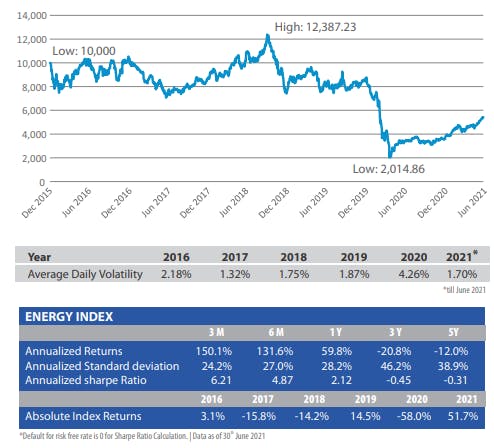

The index is rebalanced annually, at the start of the January roll period. The new weights of individual constituents are published by the exchange 3 months before the rebalancing (i.e., in October). Historical data for the index is available from 31st December 2015, when the index was assigned a base value of 10,000. Below are a few statistics of the Energy index (Source: MCX).

Computation of the iCOMDEX Energy index spot:

The index value of the iCOMDEX Energy index is computed in a similar manner as is the index value of the iCOMDEX Bullion and Base Metals index. We have already explained the index computation part in a video that we did on the iCOMDEX Base Metals index. If you are interested in understanding how the index is computed on both normal days and rollover days, we suggest you watch that Base Metals index video, by clicking here. Except for a few factors such as different commodities and rollover days, the computation logic for the iCOMDEX Energy index remains the same.

Rollover and Expiry:

The rollover of the Energy index happens two working days prior to the pre-expiry margin period of crude oil futures contracts. Meanwhile, the Energy index futures contract expires one working day before the start of the rollover period.

Note: The pre-expiry margin period is five working days prior to crude oil futures contract expiration

Let us understand how this works for the November 2021 crude oil contract.

Crude oil November futures expiry: 18th November

Pre-expiry margin period: 12th–18th November

Rollover period: 10th–11th November

Expiry: 9th November

In short, the MCX iCOMDEX Energy index futures contract would expire eight working days prior to the expiry of crude oil futures contract.

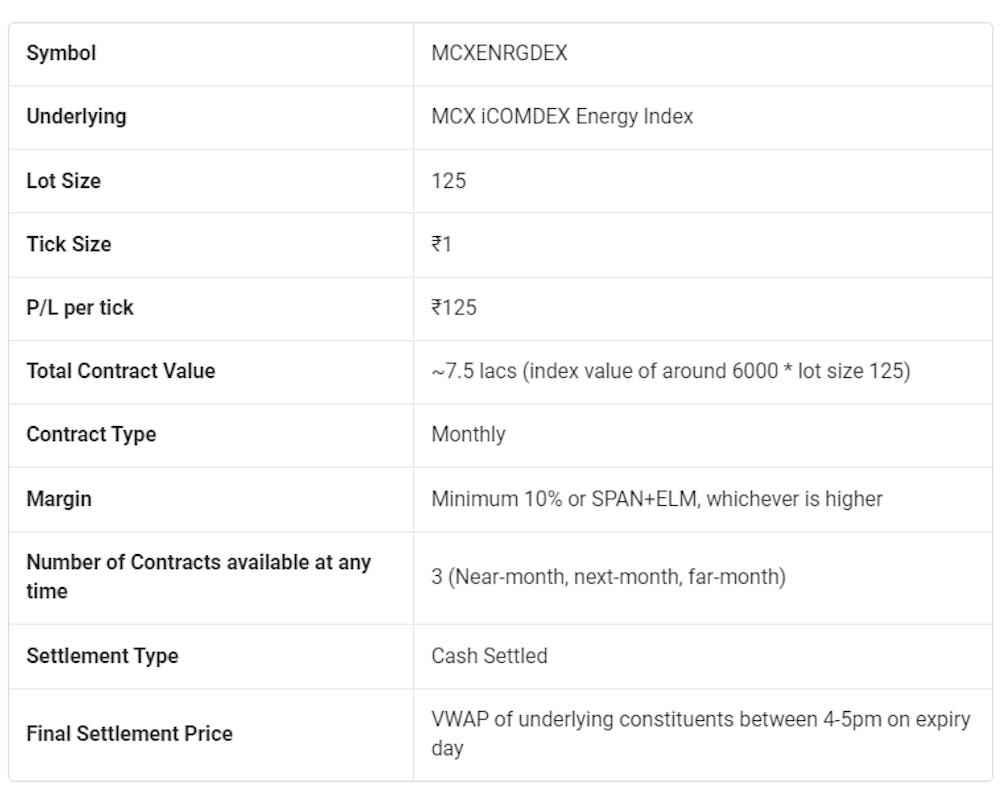

Contract Specifications:

Following are some key contract specifications of the iCOMDEX Energy index futures contract.

The detailed contract specification can be downloaded from MCX, by clicking here.

Why trade the iCOMDEX Energy Index:

Let us now talk about some of the advantages of trading the iCOMDEX Energy index futures:

Less volatile compared to individual commodity futures contracts

As you would be exposed to two commodities instead of one, the index can help in diversifying risk

Lower margin requirements as compared to taking a combined position in crude oil and natural gas futures

Can be used to hedge underlying exposure to crude oil and natural gas futures

Can be used to diversify an investment portfolio as the index shares a low correlation with equities

We are happy to inform you that the iCOMDEX Energy index futures will be available for trading on the FYERS platform. The ticker for the index is MCXENRGDEX.

Happy Trading!