Calculating profit/loss for every 1 rupee movement of underlying MCX commodities contract is a cumbersome task for the vast majority of commodity traders. It's important to understand these instruments as commodities have different contract specifications, expiry dates and vastly differing contract sizes. Commodity contracts differ from each other based upon the -

- Trading Unit / Lot size

- Base Value

- Tick Size

Due to the above mentioned differences, the P&L effect for a 1 rupee change in the underlying price can be substantially different. P&L effect of 1 rupee movement in commodities contract is one of the most commonly asked inquiries to our support team. Most of the commodity traders are not well-versed with the contract wise lot size or tick size effect on the profit-loss, which further leads to a suspicious claim over the contract note and substantially increases the inbound queries related to brokerage, P&L and so on this particular topic.

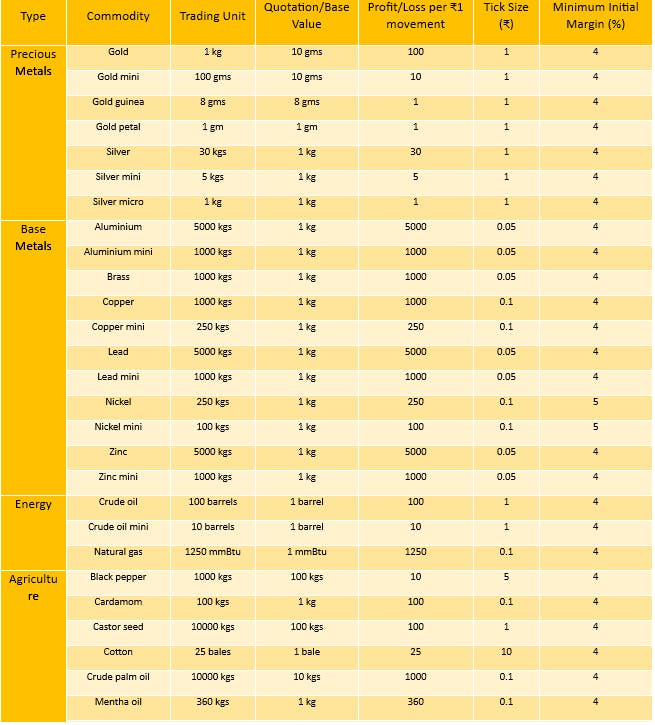

The table below shows the contract specifications for MCX commodities, the commodities are segregated into Agri, Base Metals, Energy, Precious Metals.

Here, MMBTU - Million Metric British Thermal Units

MT - Metric Ton -1000 Kgs

1 MT - 10 Quintals

1 Quintal -100 Kgs

Here, Trading Unit refers to the size (in weight) of the commodity position. For instance, the trading unit of gold is 1Kg, which means when a trader takes a position in gold it will be 1kg or in multiples thereof. A 1 lot position in gold means a trader has taken exposure to the tune of 1kg, while a 5 lot position in gold means a trader has taken exposure to the tune of 5kgs.

Quotation/ Base value refers to the unit in which the price is quoted. For instance, the quotation of gold is a price per 10 grams. This means the price that appears on the trading terminal is quoted in terms of 10 grams.

In trading, the Tick size is the smallest amount a price can change when there is a change in the underlying contract price due to supply and demand dynamics. On the trading terminal, you can see the prices quoted on “Quotation/Base Value” and not on “Trading Unit” therefore, you will not be sure whether you have to book profit or get out of the trade with a loss. The above table will help you to verify your P&L and make informed decisions.

Let’s take the example of the GOLD contract.

Trading Unit - 1 Kg - 1000 grams

Quotation/ Base Value - 10 grams

Therefore, Profit/loss for every 1 Rupee movement of the underlying contract of GOLD will result in Rs. 100.

If a trader has a long position in gold and the price of gold increases from Rs. 37,000 to Rs. 37100, the trader would profit Rs.10,000 (100* (37,100 - 37,000)). Conversely, a short position would mean a loss Rs. 10,000 in case the price of gold moves up by 100. If you have multiple lots, use the multiplier to get the exact P&L effect.

Further, you can also use our Brokerage Calculator and Margin Calculator to know the exact brokerage and margin required for carrying out the commodity trades. If you want to learn more about commodity contract and specifications, I recommend you to read this chapter on School of Stocks. If you have any questions, you can ask us in the comments section below.