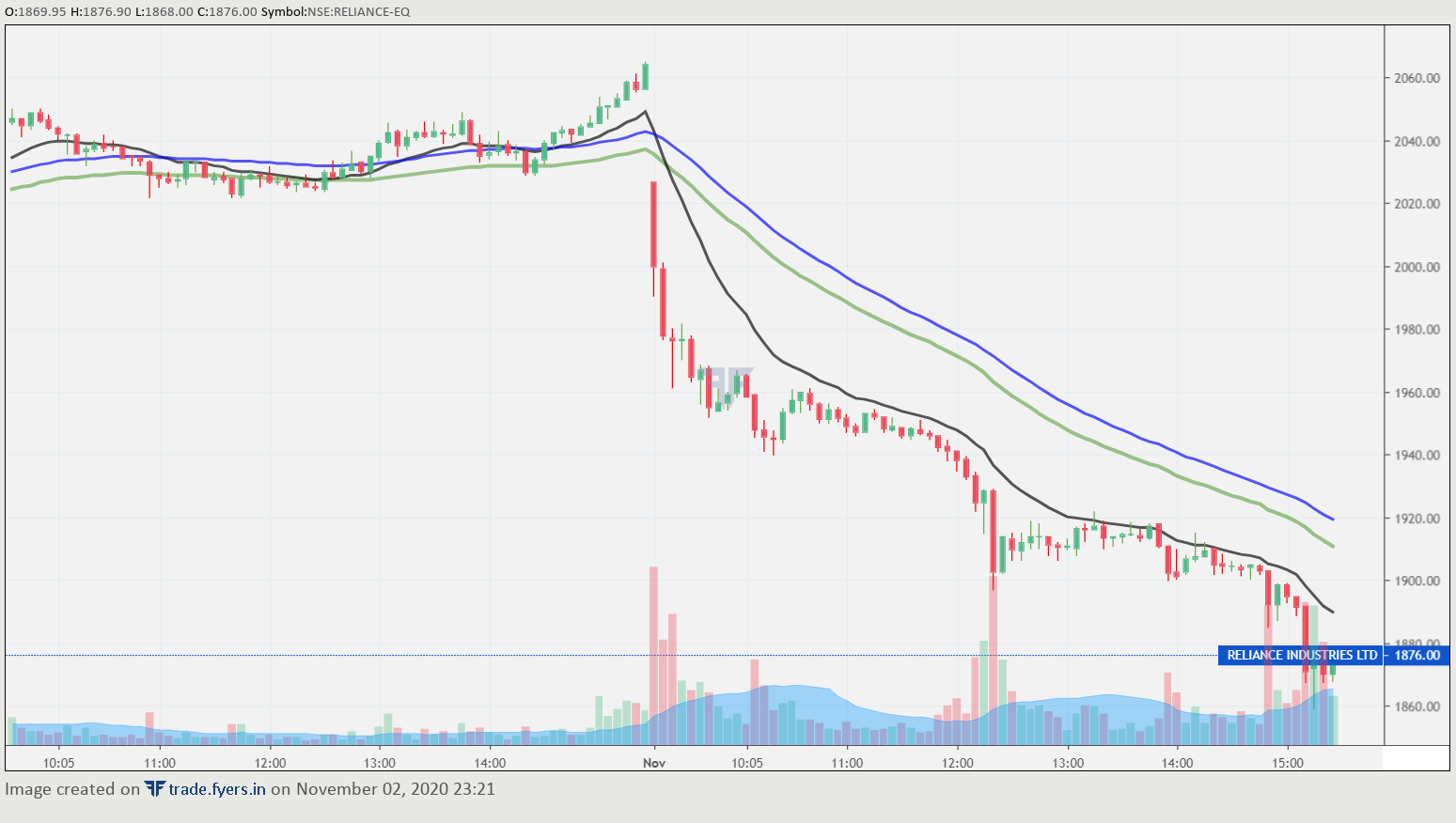

Reliance Industries quarterly results were a little bit subdued. However, TV channels maintained the view that it was a beat on estimates. But when the stock market opened on 02 Nov, it was clear.

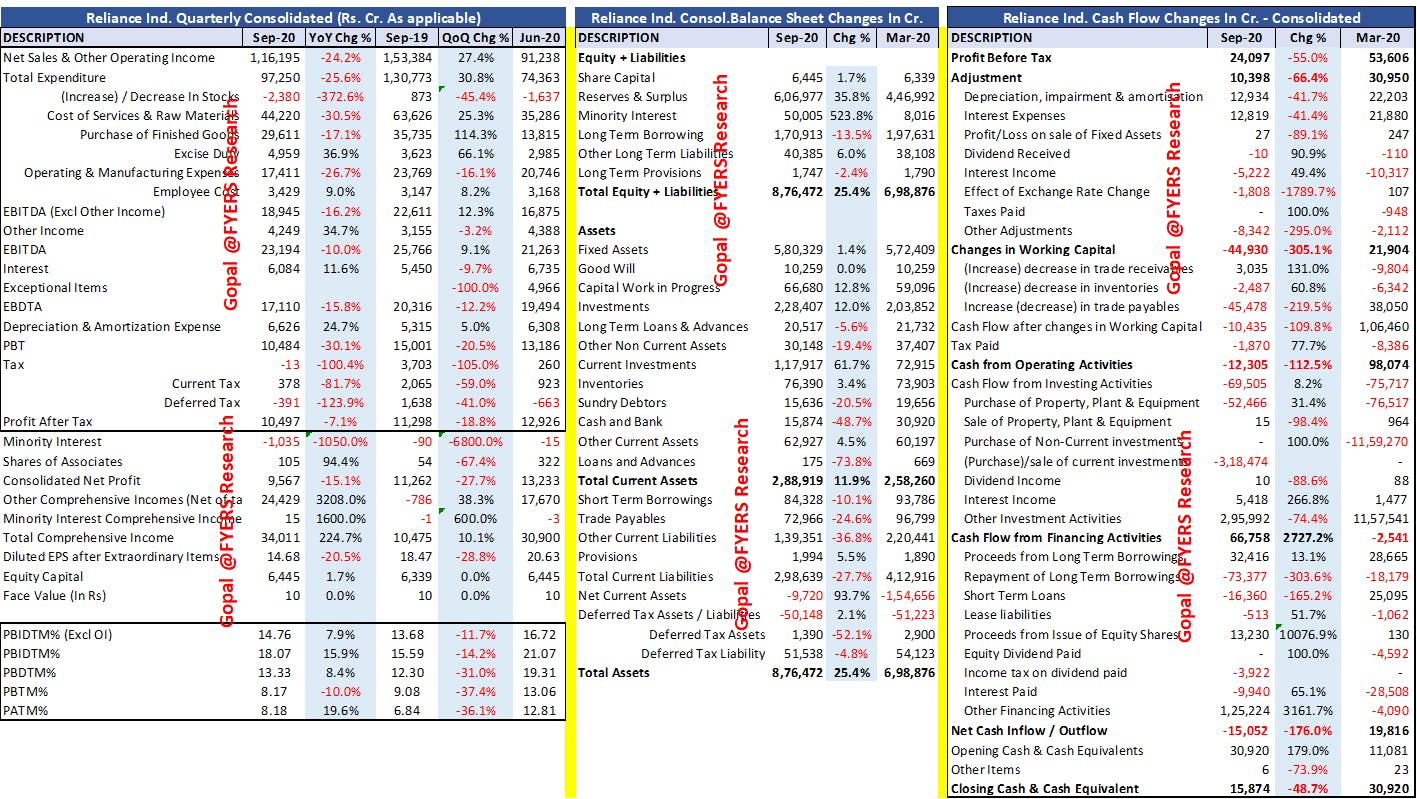

Consol. Numbers:

- Revenue: 116,195 cr vs. 153,384 cr (yoy) vs 91,238 cr (qoq)

- EBITDA: 18,945 cr; EBITDA Margin at 17%

- PAT: 10,602 cr vs 11,352 cr. (yoy) vs. 13,248 cr (qoq)

- EPS: 14.68 vs 18.47 (yoy) vs 20.63 (qoq)

- Net Profit: down 20% (yoy)

- Outstanding debt: 279,251cr

- Cash & equivalent: 185,711cr

- Oil & Gas Rev.: down 29.8% (qoq)

- Refining EBITDA down 21.4% (qoq)

- GRM: $5.7/bbl vs $6.3/bbl (qoq) vs $9.4/bbl (yoy)

- Retail Rev.: 41,100 cr; EBITDA: 2,006 cr (EBITDA margin: 4.8%)

Telecom Cos (qoq) Revenue growth in the current quarter

- 5.6% Reliance Jio

- 1.2% VodaIdea

- 7.4% Bharti Airtel

- Reliance Jio ARPU: 145 (Q2FY21) vs. 140 (Q1FY21) vs. 127.4 (Q2FY20)

- Vodafone ARPU: 119 (Q2FY21) vs. 114 (Q1FY21) vs. 107 (Q2FY20)

- Bharti Airtel ARPU: 162 (Q2FY21) vs. 157 (Q1FY21) vs. 128 (Q2FY20)

Jio Q2:

- 5% growth on topline; 13% growth on bottom line

- Revenue: 17,481 cr vs. 12,345 cr. (yoy) vs. 16,557 cr (qoq)

- PAT at 2,844 cr

- Jio ARPU: 145

An overall financial scape of Reliance Industries latest quarterly results.

Rgds

Gvk