Update from Ace Equity

Snapping six straight sessions of gains, Nifty ended lower on Tuesday on the back of profit booking. Market made a positive start, as traders took support with Finance Minister Nirmala Sitharaman’s statement that the government is taking steps to carefully monitor the fiscal deficit, which is estimated at 9.5 percent of the Gross domestic product (GDP) for the current financial year.

She said the 'mool mantra' now is that fiscal deficit is something that one cannot escape, but at the same time, it needs to be carefully tackled. Further, market added more gains after European Union stated that its first high-level dialogue on trade with India saw interest by both sides in resuming negotiations for an ambitious, comprehensive and mutually beneficial trade and investment pact once their respective approaches and positions are ‘close enough’.

Index maintained its positive trend, as private report stated that India will make up the biggest share of energy demand growth at 25 percent over the next two decades, as it overtakes the European Union as the world's third-biggest energy consumer by 2030. However, in last leg of trade, market dragged lower to end the session in red zone.

Most of the sectoral indices ended in red except Bank, PVT Bank and Financial services. The top gainers from the F&O segment were Tata Chemical, Indus Tower and SBI Life Insurance. On the other hand, the top losers were Balkrishna Industries, Torrent Pharmaceuticals and IOC. In the index option segment, maximum OI continues to be seen in the 14100 - 16000 calls and 13,700 - 14,500 puts indicating this is the trading range expectation.

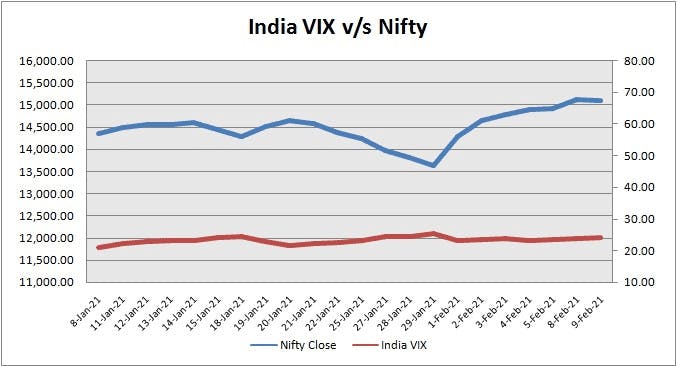

India Volatility Index (VIX), a gauge for market’s short term expectation of volatility increased by 1.30% and reached 24.27. The 50 share Nifty down by 6.50 points or 0.04% to settle at 15,109.30.

Nifty February 2021 futures closed at 15103.80 (LTP) on Tuesday, at a discount of 5.50 points over spot closing of 15109.30, while Nifty March 2021 futures ended at 15145.00 (LTP), at a premium of 35.70 points over spot closing. Nifty February futures saw an addition of 3,745 units, taking the total open interest (Contracts) to 1,50,219 units. The near month derivatives contract will expire on February 25, 2021 (Provisional).

From the most active contracts,

- Reliance Industries February 2021 futures traded at a premium of 9.50 points at 1963.50 (LTP) compared with spot closing of 1954.00. The numbers of contracts traded were 41,454 (Provisional).

- SBIN February 2021 futures traded at a premium of 1.70 points at 395.75 (LTP) compared with spot closing of 394.05. The numbers of contracts traded were 28,934 (Provisional).

- ITC February 2021 futures traded at a discount of 1.45 points at 227.30 (LTP) compared with spot closing of 228.75. The numbers of contracts traded were 25,441 (Provisional).

- Tata Steel February 2021 futures traded at a premium of 1.15 points at 702.15 (LTP) compared with spot closing of 701.00. The numbers of contracts traded were 24,315 (Provisional).

- Asian Paints February 2021 futures traded at a premium of 3.05 points at 2511.05 (LTP) compared with spot closing of 2508.00. The numbers of contracts traded were 21,901 (Provisional).

Among, Nifty calls, 15200 SP from the February month expiry was the most active call with an addition of 2,806 units open interests. Among Nifty puts, 15000 SP from the February month expiry was the most active put with an addition of 4,115 units open interests. The maximum OI outstanding for Calls was at 15500 SP (26,075 units) and that for Puts was at 14000 SP (42,907 units). The respective Support and Resistance levels of Nifty are: Resistance 15,222.83 -- Pivot Point 15,143.57 -- Support -- 15,030.03.

The Nifty Put Call Ratio (PCR) finally stood at (1.63) for February month contract. The top five scrips with highest PCR on SBIN (1.60), ICICI Bank (1.25), HDFC Bank (1.16), UltraTech Cement (1.10) and Shriram Transport Finance Company (1.09).

Among most active underlying, Tata Motors witnessed an addition of 238 units of Open Interest in the February month futures contract followed by SBIN witnessed an addition of 474 units of Open Interest in the February month futures contract, Tata Steel witnessed an contraction of 341 units of Open Interest in the February month futures contract, Bharti Airtel witnessed a contraction of 31 units of Open Interest in the February month futures contract and Reliance Industries witnessed a contraction of 160 units of Open Interest in the February month futures contract (Provisional).