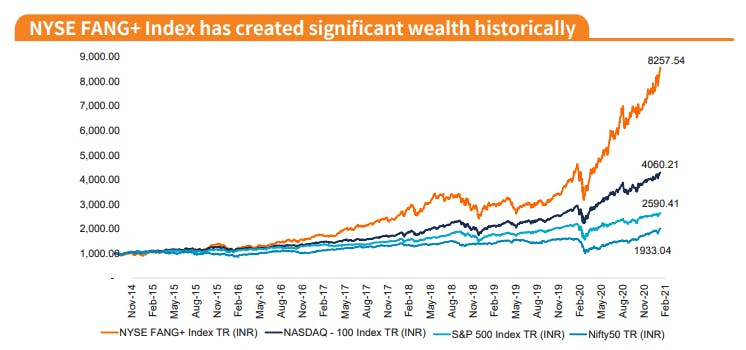

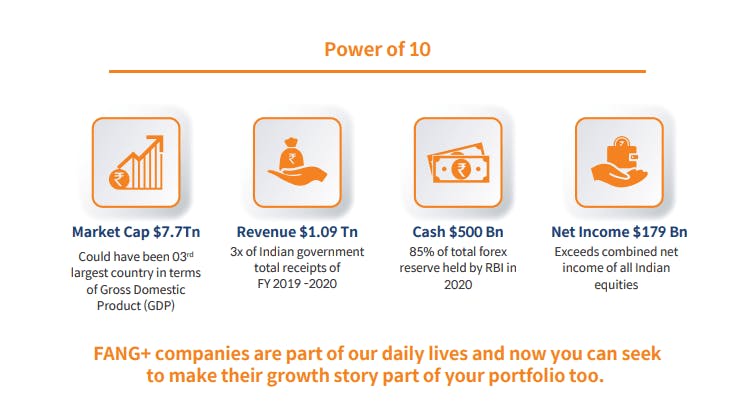

Investing in US markets & FAANG stocks, in particular, is gaining immense popularity. These consumer-tech companies have gained unparalleled power & influence over the digital consumption of the human population around the world. The overwhelming number of first-time investors from the zillennial & millennial generations relate more to brands like Facebook, Apple, Netflix, Google, etc than the lesser-known domestic companies in India simply because they use these companies' products/services in their daily lives. On the other hand, young investors are skeptical about investing in companies that they have never heard of, even if they have showcased great financial performances. Here are some fun facts about Mirae Asset NYSE FANG + ETF/Mutual Fund:

We recently organized a webinar with Mirae Asset Management Company (AMC) to help our clients understand the benefits of investing in this portfolio. You can watch it here.

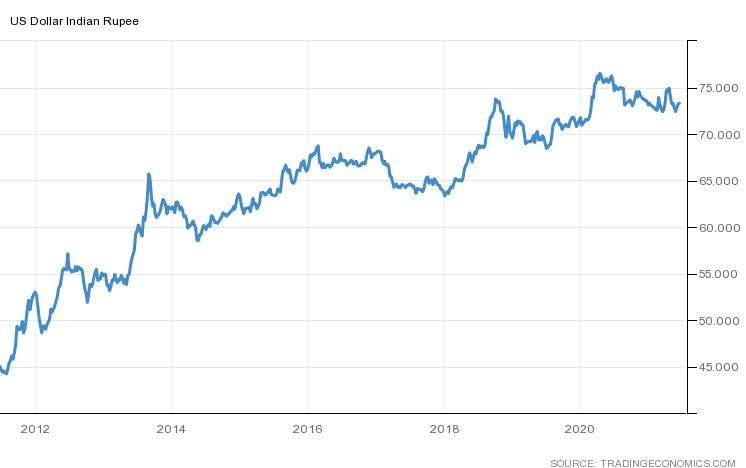

The most neglected benefit of Global Investing is the fact that you can benefit from the depreciating value of the Indian Rupee (INR). Historically, the US Dollar has consistently gained value against INR. 10 years ago, our currency was valued at 45. Today it is 73 against the dollar - A cool 62% higher!

The best way to invest in FAANG & other popular US stocks for the long-term is through ETFs. Why?

- It's hassle-free because you can do it from your existing brokerage account without having to go through the tedious A/C opening process with a US brokerage.

- Zero remittance fees as there will be no foreign exchange transaction taking place at the end client level. You can save a minimum of 5% of your capital right away.

- Zero brokerage fees as there is no foreign broker and doesn't involve purchasing these stocks directly on NYSE. Also, we don't levy any brokerage for investments so you get to save even more.

- Zero distributor commissions if you invest through FYERS Direct MFs. You will save an extra 0.79% annually through us.

How to Invest in Mirae FANG+ ETF/FoF MF:

- Direct Mutual Fund - You can access the FoF Direct MF & invest here.

- Exchange-Traded Fund (ETF) - Search for 'MAFANG' on FYERS Web/App to invest.

Cost-wise and otherwise, there is not much of a difference if you invest in this portfolio through either of the above two options. If you have any more doubts, you can ask us in the comments section below.

Happy Investing!