One fine day, Mr. X was holding an ITM (in-the- money) Call Option which he bought a few days ago and his position was going to expire on the same day. He was happy that he’d make handsome profit on the trade and he hence didn’t square off the position assuming it would get expired by end of the day. However, in the evening he received a contract note from his broker leaving him shocked for making a loss on his trade. He immediately called his broker in anxiety to know about the suffered losses and was informed that due to STT (Securities Transaction Tax) his actual profits turned into losses.

Imagine yourself in the above situation. If you are an active options trader then there is something which you must know about and that is the “Trap of STT on options expiry”.

Few things to analyze from the above case:

1. Why did the ITM option end up making loss on expiry? What went wrong by Mr. X?

2. Why is it necessary to square off ITM options rather than let them expire/lapse on the expiry day?

3. What is STT and how does it affect your profitability?

Let’s clarify the answers for each question above.

a. The reason why ITM option ended up making loss is because it was not squared off on the expiry day and hence considered as exercised by the holder (Mr. X) of the option. But what’s wrong with that! Ideally, whenever an option position is not squared off on expiry then the liability of paying STT is levied on the Buyer of the option.

b. Note that the value of an ITM option trades lesser than its actual theoretical value on expiry day since it gets adjusted to the STT (Securities Transaction Tax) component. Let’s take an example, assume it is the last day of expiry with Nifty at 8500 (spot price) and if you buy an 8450 CE or 8550 PE and hold it until the end of the day then theoretically the option premium should be Rs. 50 (Premium = Intrinsic value + Time Value). However, the actual option premium will have to adjust against the STT which is eventually levied on the Buyer of the option if considered exercised.

STT on Exercised options on Expiry of Options = 0.125 % * (Strike Price + Premium) * Quantity

Therefore in the above example, if you don’t square off the position before it expires then it will be considered as exercised and you as a buyer will have to pay Rs. 796.9 ((8450+50)*75*0.125%) as STT.

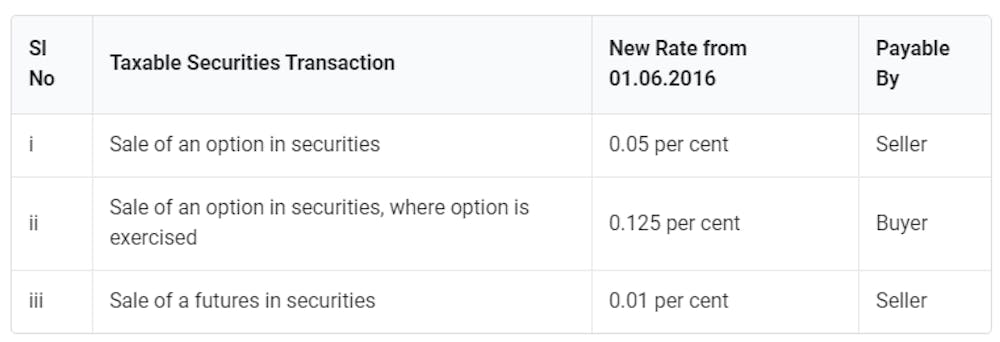

c. It is necessary to understand what the STT (Securities Transaction Tax) is and how it affects the profitability. STT is a type of tax levied on gains from securities. This includes mainly equities and futures and options. The rate of taxation is different for different types of securities. STT can basically be understood as a type of tax levied on transactions done in the domestic stock exchanges. Securities transaction tax (STT) is a direct tax and is levied and collected by the central government of India.

The most prominent point about securities transaction tax is that STT is applicable only on share transactions made through a recognized stock exchange in the country. Off-market share transactions are not covered under STT.

Points to remember:

• It is wise to square off an ITM option position before it gets expire to change your status from option “Buyer” to “Seller” and avoid paying STT on expiry.

• In case if you hold ATM (At the Money) or OTM (Out of the Money) options, then there’s no need of squaring it off as the option doesn’t hold any value, therefore the STT is not applicable on zero value options.

• Fyers is among few stockbrokers who intimate you (through email & SMS) to square off your ITM option position before expiry, if you hold any.

Update: STT Trap issue has been resolved with effect from 1st September 2019 as per this NSE Circular. The circular has been interpreted with an example in this notice.