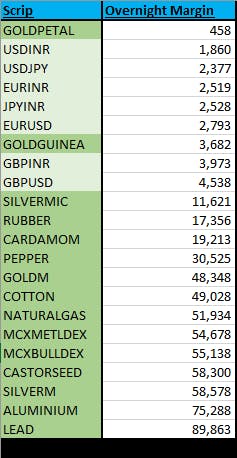

As you must know by now, as per SEBI's policies, intraday leverage will be removed completely by 1st September 2021. If you're a trader with less capital that mainly traded futures using margins provided by the broker and you're wondering how to cope with the upcoming change, here's a list of futures contracts on NSE, MCX that require less than 1 lac in initial margins (As per the latest near-month expiries):

Notice that all the above futures contracts are of currencies & commodities. Currencies have become more volatile during the pandemic and the low margin requirements certainly help take advantage of the price movements of INR and cross-currency pairs. Among the commodities that are mentioned, GoldM, Natural Gas, SilverM are amongst the most traded scrips by our clients. MCX index derivatives are easier to trade as they represent baskets of commodities (inherently diversified), cash-settled, and have relatively low margin requirements. There isn't much awareness about these indices, so if you want to learn more, watch our videos on BULLDEX & METLDEX. The newly introduced FINNIFTY futures contracts are also an exciting proposition for less capitalized futures traders in 2021 although it requires approximately 1.27 lacs. However, it is much lower than BankNifty and Nifty both of which need above 1.6 lac margins per lot. Trading stock futures is far fetched as the margin requirements are out of the league for most retail clients.

If you think the upfront margin collections are going to relegate you from futures trading altogether, you can perhaps consider trading ITM options (Buying). If this sounds new to you, read this answer. In short, ITM options have intrinsic value and require lower margins as compared to futures. If you are uncomfortable with options trading due to time decay (Theta), buying ITM is the closest it comes to futures because the delta is higher (The deeper ITM options are better because they move in line with the underlying prices, but you'll need to watch out for liquidity).

Note: We currently do provide intraday leverage as mentioned in our margin calculators. This is just a discussion point. The upfront margin collection is being implemented in a phased manner and intraday leverage will be completely eradicated in F&O by 1st September 2021.