When SEBI announced peak margin policies, market observers and critics predicted that brokerages will be doomed because volumes would crash by up to 50% or more. It was predicted that the entire trading ecosystem will be severely affected and that the party was over.

So far, the opposite is true! Despite the sharp de-leveraging in March (2x leverage in F&O and max 10x in Equities), trading activity has sustained. Apart from a mild dent in Stock Futures and Equities in March, other segments have done well. It just goes to show that new investors are not going to back out because of higher margins! Will this sustain after August 2021 when leverage will be 1x in F&O and max 5x in the equity segment? Hmmm, maybe but we've all been wrong about this so far.

Some updates on volume trends:

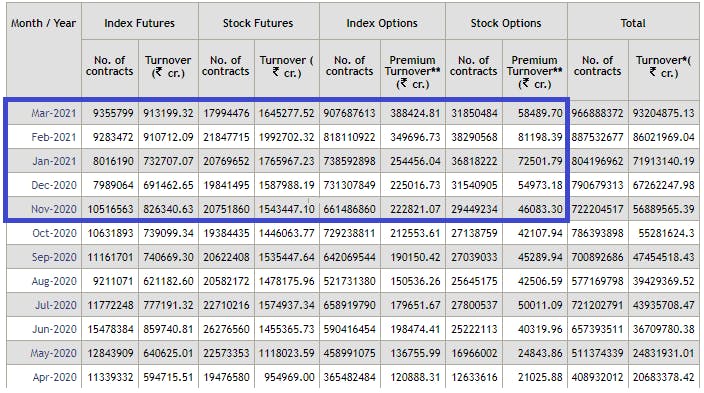

- Index Options turnover is at an all-time high.

- Stock Options turnover is steadily increasing (Although Jan & Feb were higher).

- Index Futures turnover at an all-time high.

- Stock Futures turnover down by 10% from Dec.

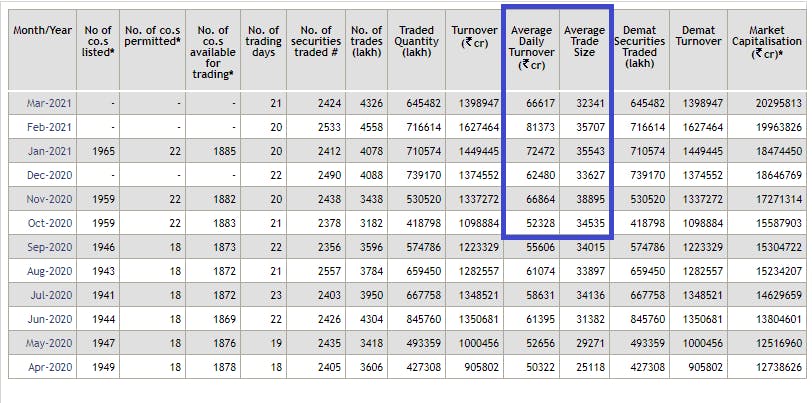

- Avg. equity trade size hasn't reduced much.

- Avg. equity turnover reduced to November levels.

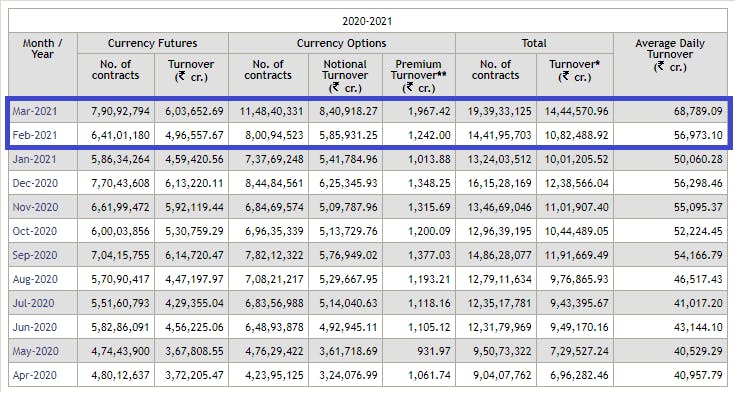

- Currency Futures turnover is on a rising trend.

- Currency Options turnover is at an all-time high.

Here's the data from the NSE website:

Do you think trading volumes will sustain or is all this just a temporary Covid induced spike?