20.10.2020

People around us keep giving unsolicited advice that, in order to build wealth, investments have to be for the long term and stocks have to be accumulated over a time period. But, really, is it possible do the same with any random stock or sector?

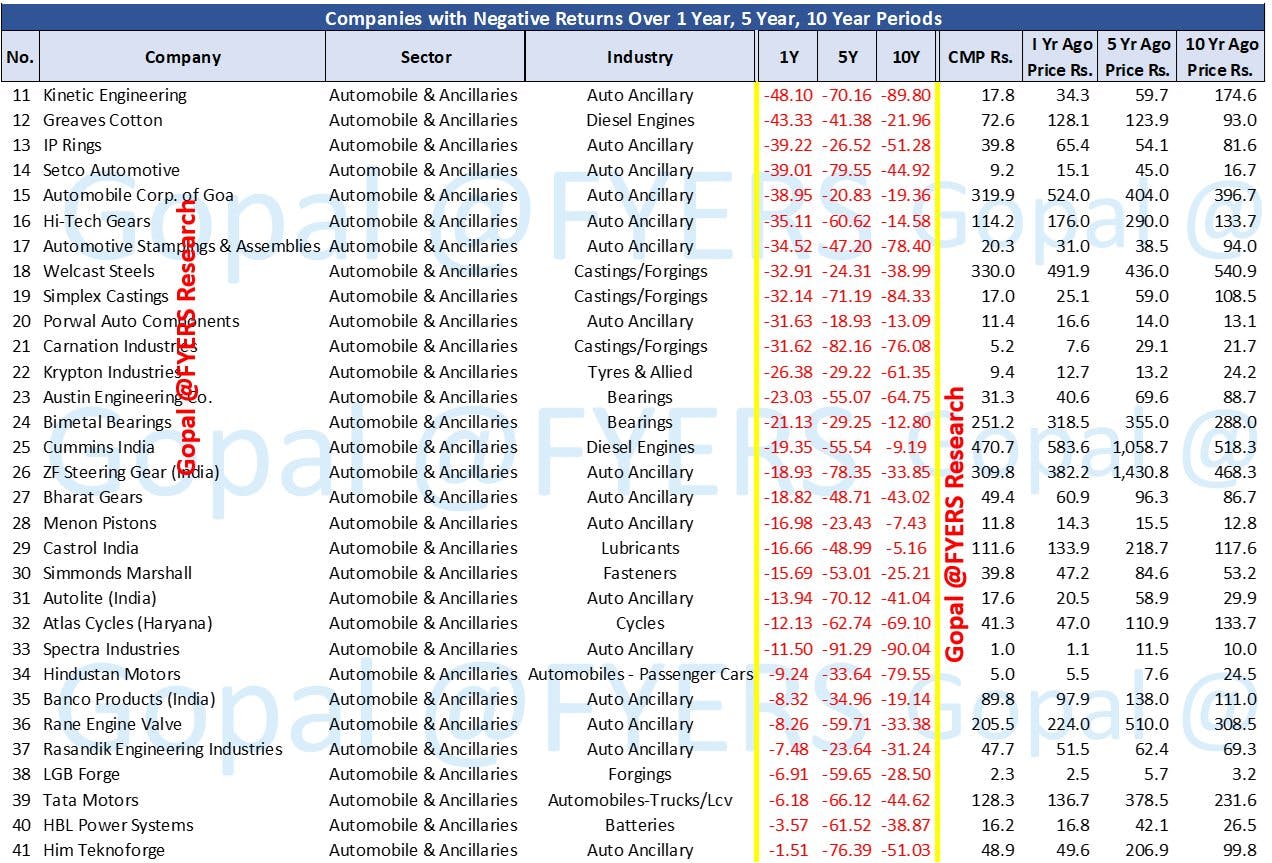

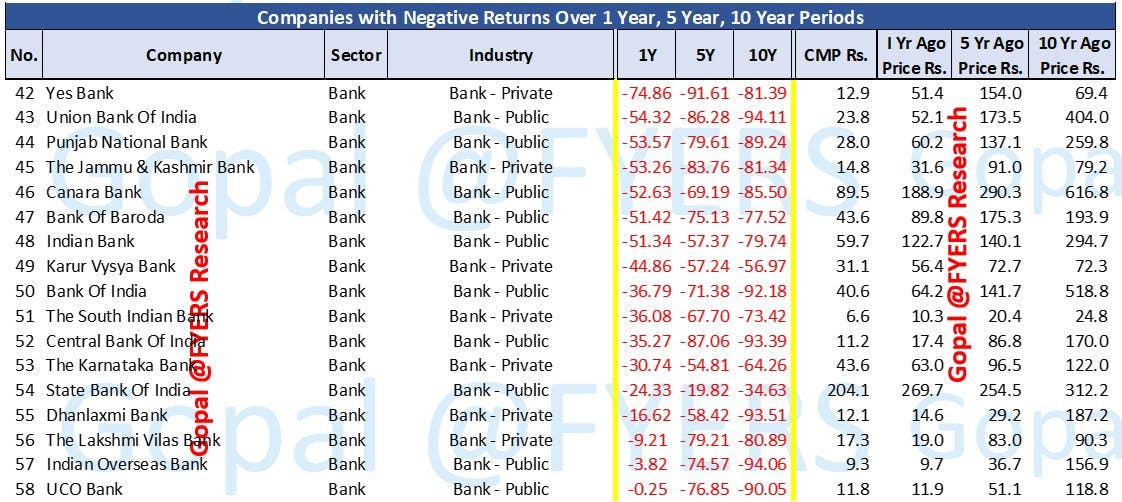

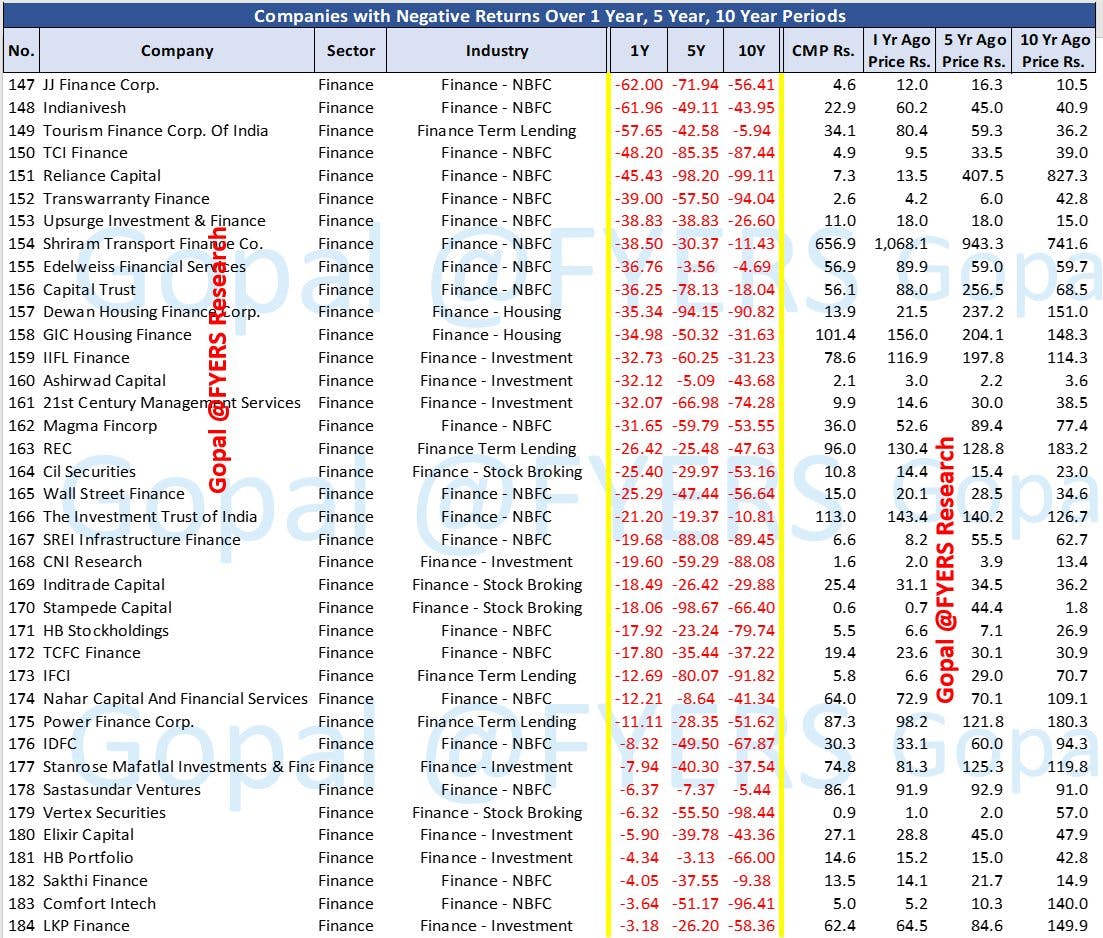

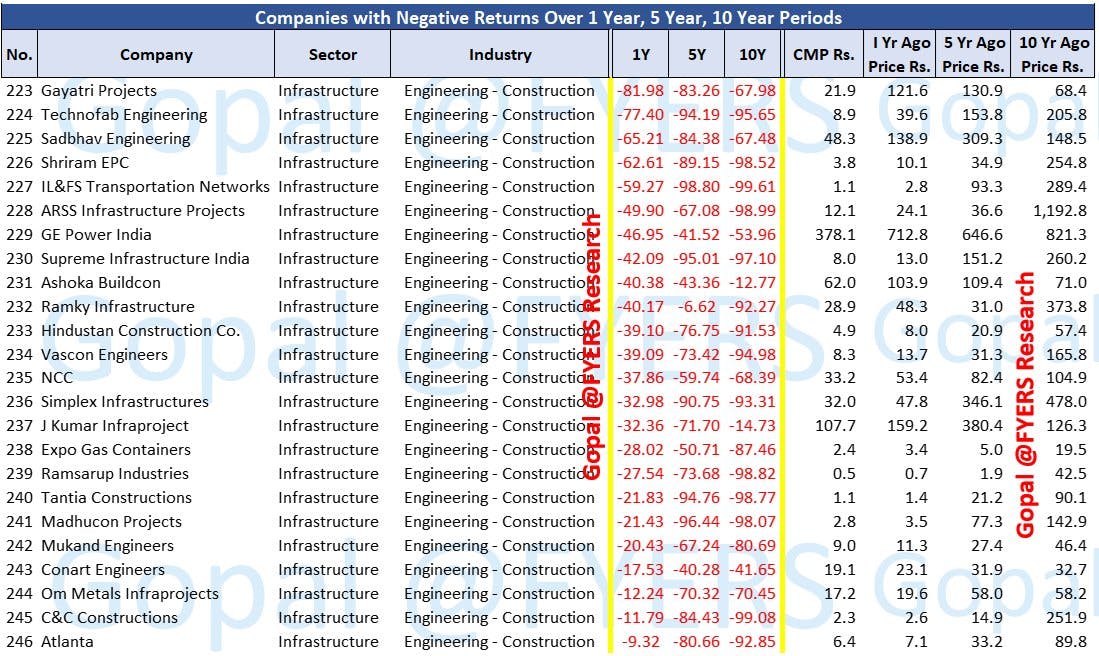

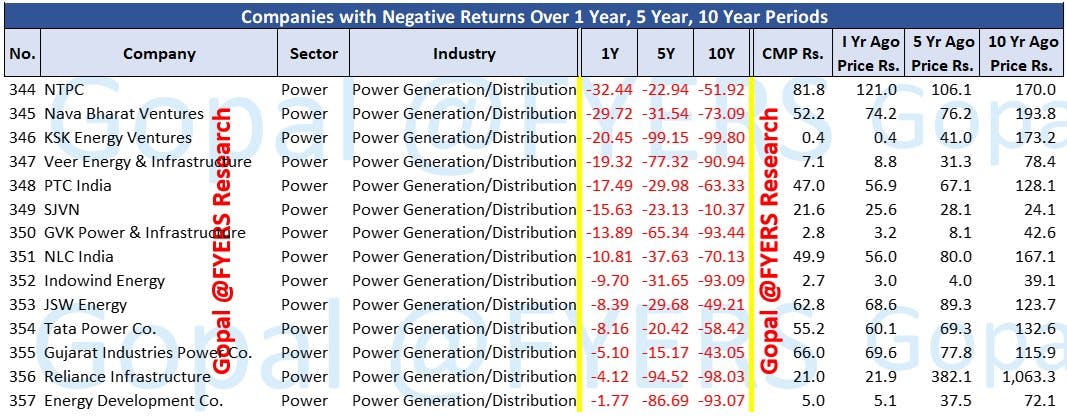

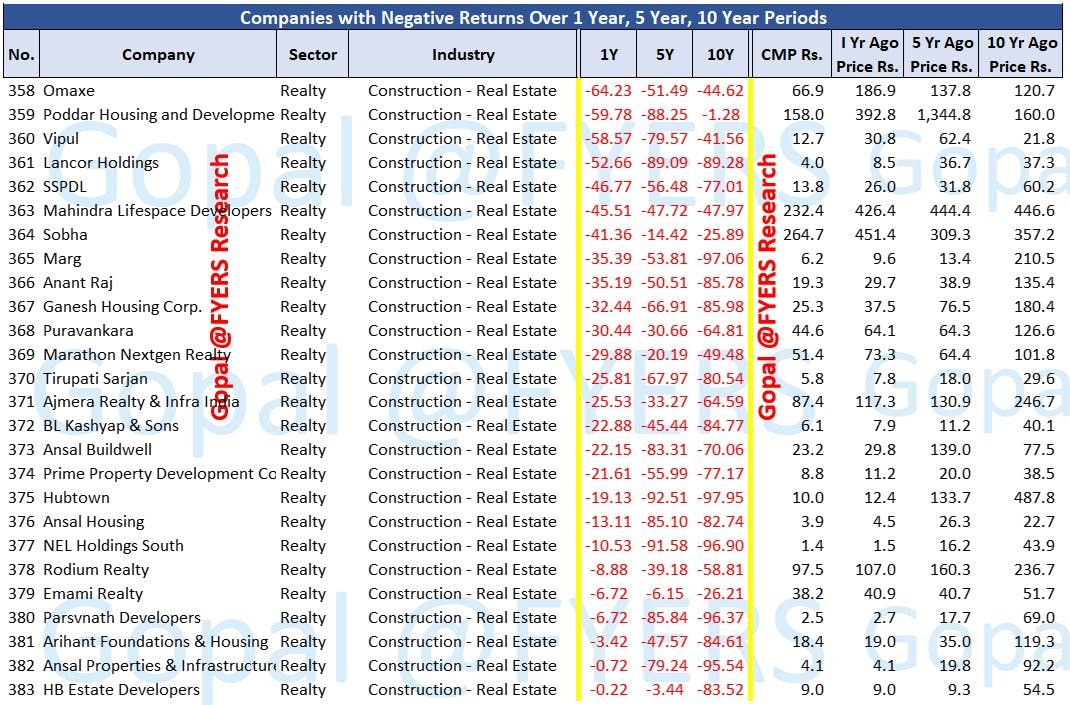

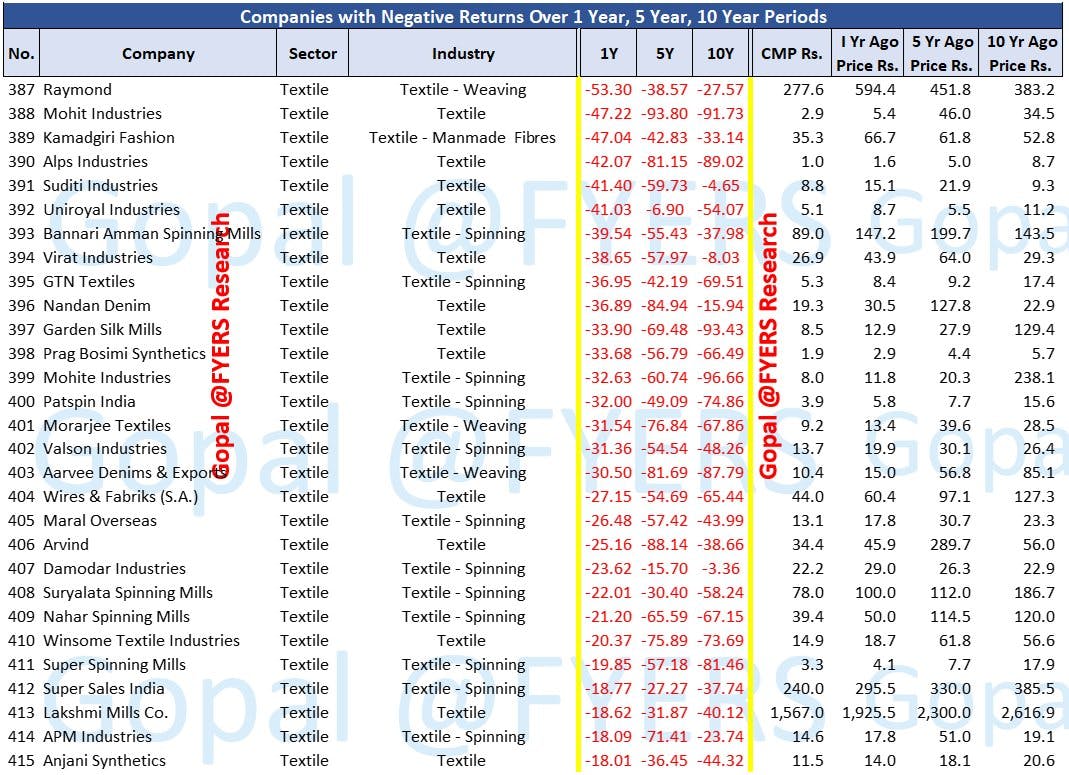

Going through 5625 listed stocks on BSE, I found that 449 stocks have eroded investor capital over 1 year, 5 year and 10 year time frames. During the course of this wealth erosion, many became penny stocks too.

The sectors are well known to all: Power, Infrastructure, Realty, Textile, EPC etc are well documented as wealth destroyers due to various reasons. Lets look at the stocks which haven't lived up to investor's expectations, even on a longer time frame.

- Automobile & Auto-ancillaries

- Banks

- Finance

- Infrastructure

- Power

- Realty (Real Estate)

- Textile

No wonder many of these sectors and stocks stand out of favor and the markets are skewed to only a few stocks and sectors. A good reason for under performance of many portfolios and MFs.

Who said Investing was easy and building wealth over long term was child's play?