Every mutual fund is available in the two flavours i.e. Regular and Direct mutual funds irrespective of the scheme's exposure and types. Back in 2013, SEBI made it mandatory for all AMCs (Asset Management Companies) to offer direct plans which would a give an option to invest in mutual funds without paying any commission or advisory fees to brokers, agents or distributors.

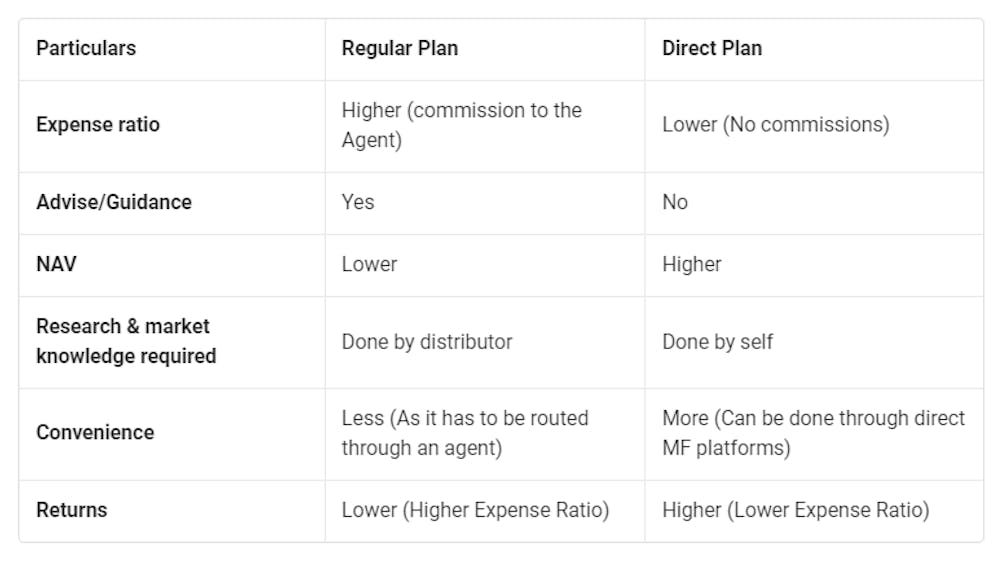

Regular and Direct mutual fund schemes are just the two options to buy the same mutual fund scheme, run by the same manager who invests in the same stocks and bonds with the same amount of exposure in them. The only difference between two is that in the case of regular plan your AMC or fund house pays a commission to your broker or middleman as distribution expenses or transaction fee out of your investment. Indeed, the situation is identical to almost any other product or service. If the manufacturer is supplying directly to the customer, then the cost can be lower. The amount of commission varies between 0.75 - 2 percent per year. Whereas in case of a direct mutual fund, no such commission is paid to the broker or distributor.

Why one should consider a direct mutual fund over a regular fund?

In spite of identically managing money in both the variants, they are not always meant for all type of investors. It is important to understand the distinctions between regular and direct mutual fund. Investors with prior experience in investing with mutual funds can easily, buy the scheme of their choice using a platform which offers direct mutual funds whereas a new investor would find it more comforting to invest through a distributor who also acts as an advisor and earns a commission as a result. The advice is thus biased towards whichever mutual fund gives the distributor higher commissions thereby potentially mis-selling a product which is not suitable to the unknowing investor.

Cost of managing funds in both types of funds is almost identical. Since regular funds offer a commission to other intermediaries from your investment pie, it gets costlier to buy regular fund schemes over a Directmutual fund. The amount of commission in regular MF schemes varies between 0.75-2 percent per year. Although your monthly statement doesn’t reflect this amount, the NAV or net asset value of your mutual fund units adjust accordingly which is not the case in the direct schemes. In addition, Goods and Services Tax (GST) is applicable to the commissions paid at the rate of 18%. Therefore, NAV of the direct mutual funds is higher than the regular funds. If you are a someone who understands what kind of mutual fundsare needed considering your financial goals, capable enough to do your own mutual fund research and wisely invest in them, you can go ahead and invest in the readily available direct mutual funds.

Though, the investment objective and investment mix of the scheme portfolio would be the same for direct or regular plans. Your agent will probably tell you that it doesn’t really matter which plan you invest in. After all, he only earns a small fee for his services. But that small fee adds up to a lot! Take the case of a 40-year old investor putting Rs 10 lakhs in a Regular Plan of a Mutual Fund, which grows at 8% a year (less 1% commission). When he retires at age 65, this investment would be worth Rs 76 lakhs. On the other hand, if he switched to a Direct Plan of the exact same Mutual Fund an eliminated this 1% annual commission, his retirement corpus would become Rs. 1 crore over the same period.In other words, a quarter of your hard-earned money ends up in the commission to the broker instead of the investment in the scheme. Whereas, regular plans don’t stop at selling you a mutual fund or reviewing it regularly. They help you facilitate and track your investment, which is more consumer friendly.

When you’re looking to invest your savings in Mutual Funds, you should look for an investment advisor that actually works in your interest. Most genuine advisors these days will not sell or recommend regular Mutual Funds because they end up costing you a recurring, hidden brokerage fee, year after year. However, the vast majority of the mutual fund distributors / advisors sell regular funds. Hence, it is very important to choose a SEBI registered Investment Advisor in case you are looking for any advice on MF investments. As per SEBI’s guidelines, such registered advisors are supposed to charge their clients directly for advice rather than earning a commission from the fund houses. Make sure you insist to invest in direct mutual funds when dealing with them as it will help you to earn a higher return due to the lower expense ratio.

We encourage you to research them independently, understand the risk and exposure of the schemes, arrive at the most suitable fund and invest through a platform which allows direct mutual fund investments.

Every rupee saved is every rupee earned!

Happy Investing!